Slide 10

When building your retirement plan portfolio, use your personal decision-making factors as a guide.

Then think about the characteristics of each asset class and what role each can play in your portfolio.

Slide 12

Stocks, Bonds, Bills, and Inflation 1926–2013

An examination of past capital market returns provides historical insight into the performance characteristics of various asset classes. This graph illustrates the hypothetical growth of inflation and a $1 investment in four traditional asset classes over the time period January 1, 1926, through December 31, 2013.

Large-cap and small-cap stocks have provided the highest returns and largest increase in wealth over the past 84 years. As illustrated in the image, fixed income investments provided only a fraction of the growth provided by stocks. However, the higher returns achieved by stocks are associated with much greater risk, as illustrated by the volatility or fluctuation of the graph lines.

Government bonds and Treasury bills are guaranteed by the full faith and credit of the U.S. government as to the timely payment of principal and interest. Stocks are not guaranteed and have been more volatile than the other asset classes. Furthermore, small stocks are more volatile than large stocks, are subject to significant price fluctuations and business risks, and are thinly traded.

About the data

Small-cap stocks in this example are represented by the fifth capitalization quintile of stocks on the NYSE for 1926–1981 and by the performance of the Dimensional Fund Advisors, Inc. (DFA) U.S. Micro Cap Portfolio thereafter. Large stocks are represented by the Standard & Poor’s 500®, which is an unmanaged group of securities and considered to be representative of the stock market in general. Government bonds are represented by the 20-year U.S. government bond, Treasury bills by the 30-day U.S. Treasury bill, and inflation by the Consumer Price Index. Underlying data is from Ibbotson.

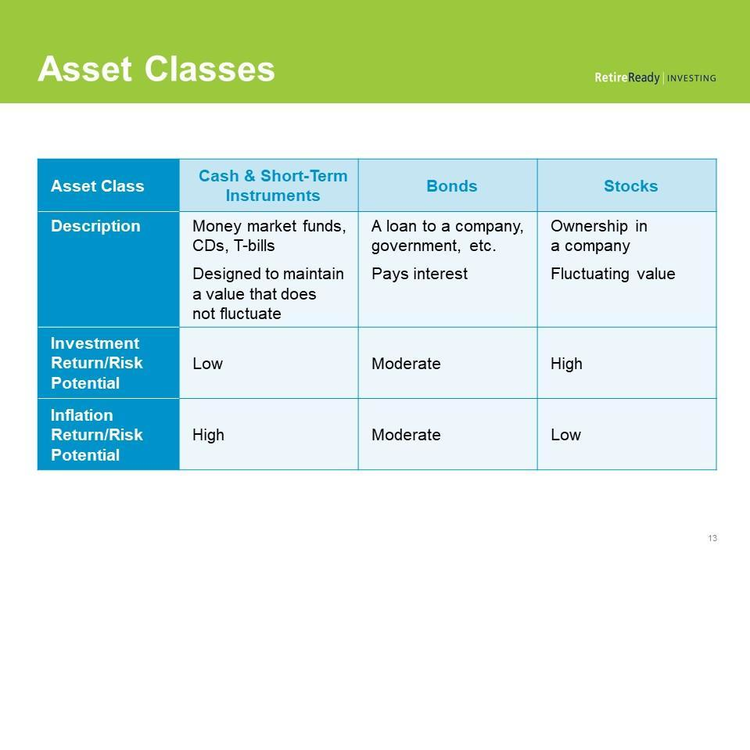

Slide 13

For example:

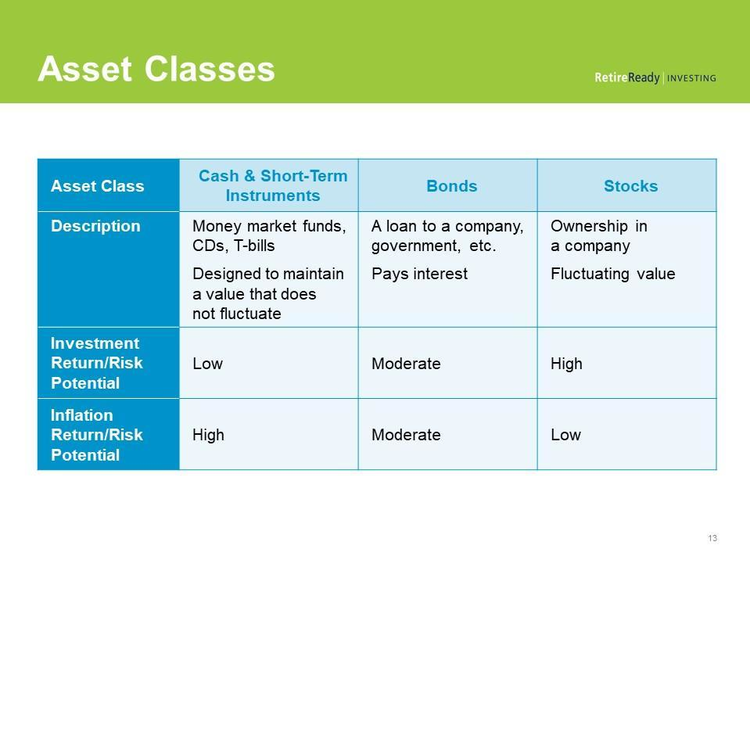

The important point to understand is that each asset class offers a certain degree of return potential and a corresponding level of risk:

Slide 14

Let’s take an in-depth look at each asset class, starting with cash and short-term instruments. These debt securities are designed to return your money with interest after a given period of time.

They include money market funds, bank notes, certificates of deposit (CDs), U.S. Treasury bills, and bank savings accounts.

Because short-term instruments seek to preserve the value of your investment at $1 per share plus interest, they are considered the most conservative type of investment—although there are no guarantees. Remember that the trade-off for that stability is that short-term instruments typically offer lower returns than the other asset classes.

Slide 15

Bonds are debt agreements. A bond certificate is like an IOU; it shows the amount loaned, the rate of interest to be paid, and the date the principal will be paid back.

Bonds are issued by corporations and government entities, the issuers. Examples of bonds include:

The issuer agrees to return the money after a certain time and to make regular payments of income (i.e., interest) along the way.

Bonds typically pay a higher return and incur somewhat more risk than short-term investments.

The value of a bond goes up and down depending on interest rates. When interest rates go up, bond prices tend to go down, and vice versa.

Slide 16

A stock is a share of a company. When you buy a stock, you are buying a piece of the company. The more shares you own, the more equity ownership you have in that company. Stocks are often called equity investments or equities.

Stocks offer greater long-term growth potential than either bonds or short-term investments. The trade-off for higher return potential is greater price fluctuation. The value of shares goes up and down depending in part on how well the company is doing.

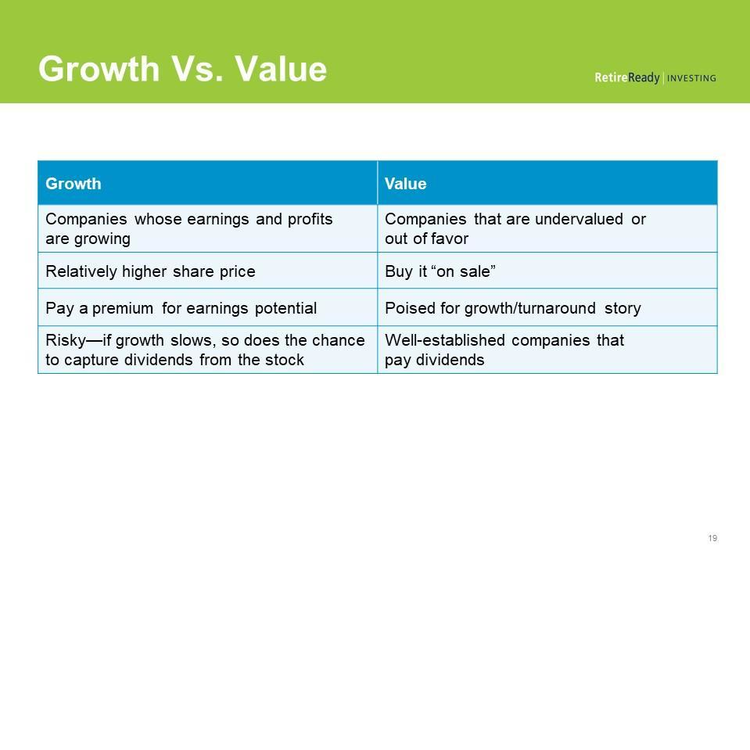

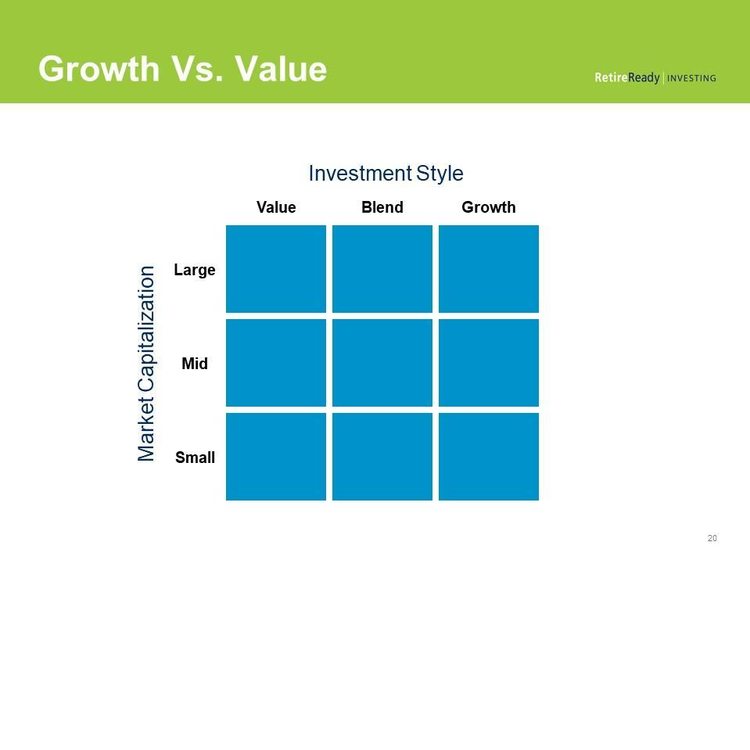

Within this asset class, there are subclasses—or subcategories—that are generally grouped according to:

• Capitalization – company size

• Growth/value – investment style

• International – country and region

Slide 17

A mutual fund is a pool of investments that can include stocks, bonds, and short- term investments. Each fund is owned mutually by many shareholders and is managed by a professional investment company, such as John Hancock.

A mutual fund has a prospectus that defines the types of investments the fund can own. For example, one fund might invest primarily in stocks of large corporations, and another might invest mostly in bonds. The prospectus also explains the fund’s investment objective, such as capital growth or current income.

A mutual fund generally has a portfolio manager—or sometimes a team of managers—who is responsible for choosing the investments held in the fund.

Because the assets in a mutual fund are diversified—that is, they are spread among a variety of investments—investing in mutual funds is considered less risky than investing in individual securities. Diversification is one way you can help minimize risk while helping maximize the growth potential of your investments. Always remember, however, that diversification does not ensure a profit or protect against a loss.

Slide 21

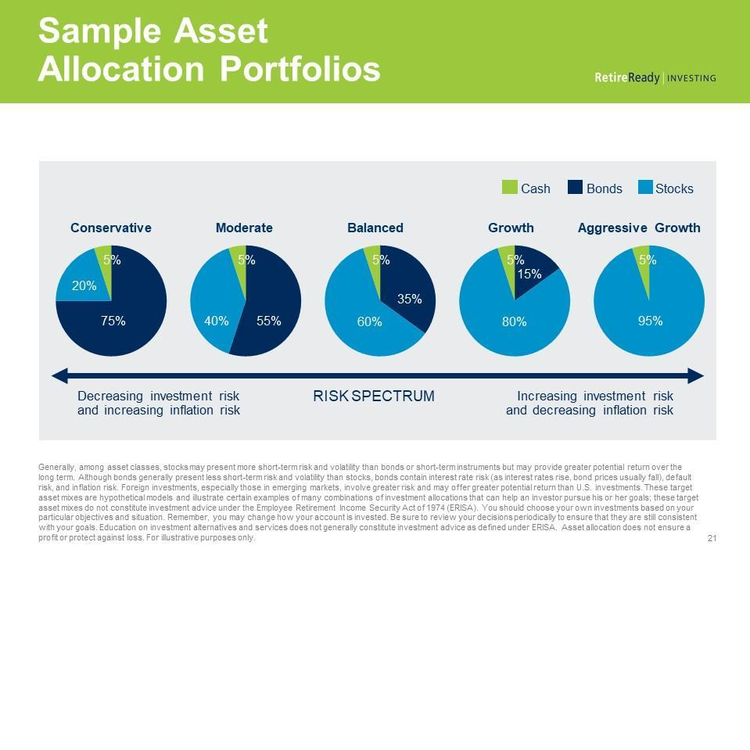

If you want to manage your workplace savings plan on your own, you should consider becoming involved in the asset allocation of your investments. The understanding you gain will be valuable to you in pursuing your retirement income goals.

There are a couple of ways to get involved in managing your account. You can tackle it yourself using the resources available on your plan sponsor’s website. Or, you can work with an advisor. Either way, you’ll start by gathering your personal and financial information.

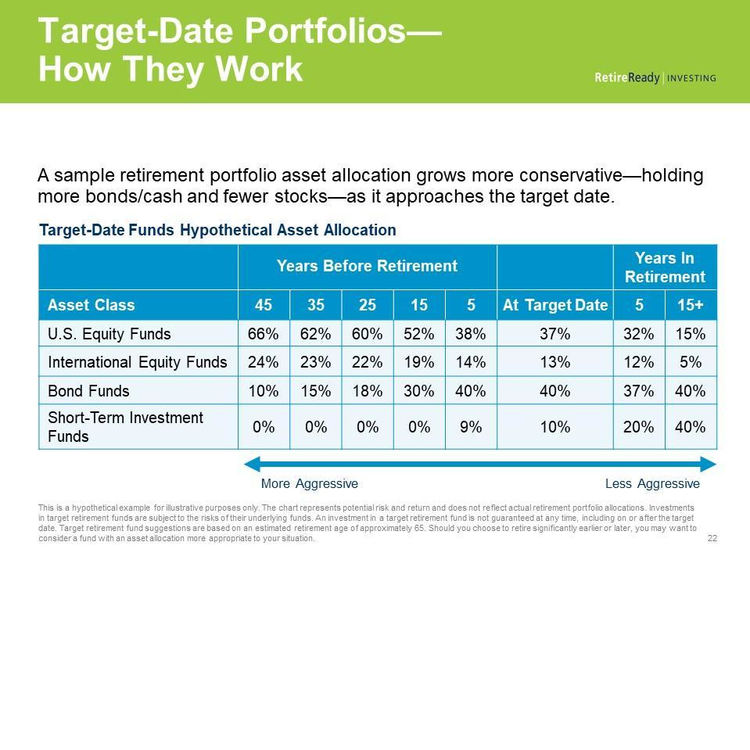

Next, you will be shown several target asset mixes, like these pie charts, that illustrate how you can put together portfolios with different levels of risk—from conservative to aggressive. When you decide the level of risk you want in your portfolio, you can use one of the sample target mixes as a guide for choosing the funds.

There is no one right allocation that meets everyone’s needs. Each investor has to evaluate the options in terms of his or her own objectives, financial needs, risk comfort level, and time horizon.

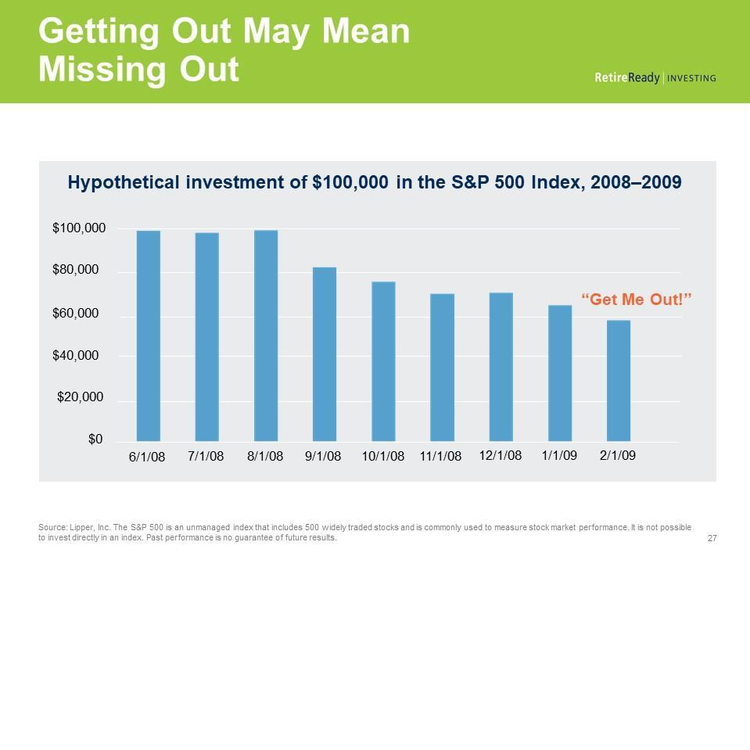

Slide 27

A bear market will do one thing to your investments: decrease the value of your holdings. This should only concern you if you plan to sell your stock right away. Remember that a depressed market and lower stock prices can be a good thing for the long-term investor looking for value.

This hypothetical example illustrates $100,000 invested in the S&P 500 Index beginning June 1, 2008. Three months later, this investment would be worth $82,579. So the investor lost about $14,421 so far. Another three months go by and the investment has dipped even lower, to $70,562. Now the investor has lost more than 29%. Should she pull out? The investor decides to stay in for a while longer, but at the eight-month point, the value is down again, this time to $57,425. At this point, the investor may say to her advisor, “Get me out now!”

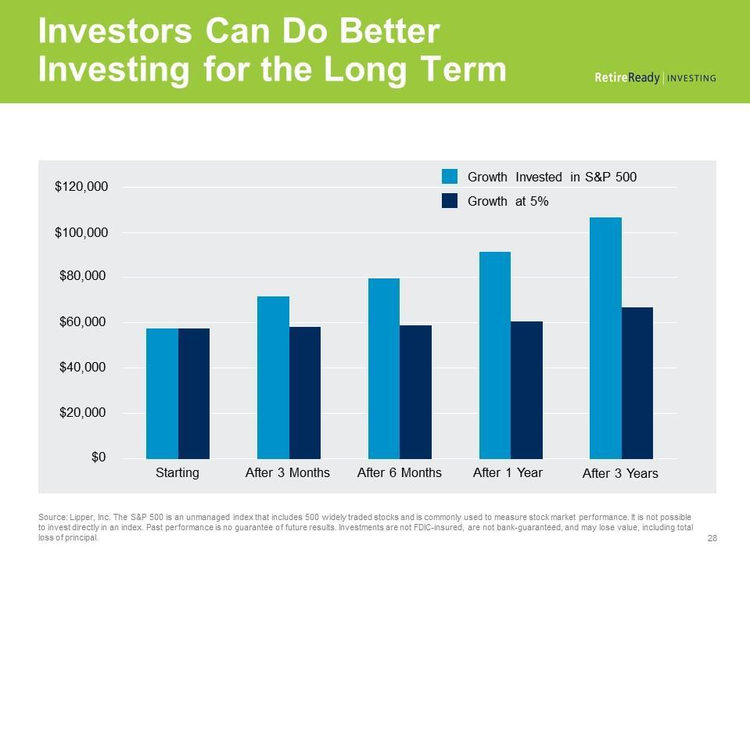

Slide 28

If the investor got out of the market, she may have avoided more down days, but it also means she missed out on the up days when the market bounced back. Let’s look at the hypothetical $57,425 that the investor pulled out of the S&P 500 Index on February 1, 2009.

Say the investor put the money into a savings account bearing a 5% interest rate. Let’s see how this would have performed compared with leaving the money in the S&P 500 Index. Three months later, the S&P started to rebound, and the investment value would have increased to $71,803. However, the investor moved this money to a savings account where the value also increased, but only to $58,791.

After three years, the savings account would yield $66,706; the S&P 500 Index would yield $106,687. The investor would have had nearly $40,000 more if she had stayed in the S&P 500 Index even after the market’s decline, so she would have done much better in the long run.

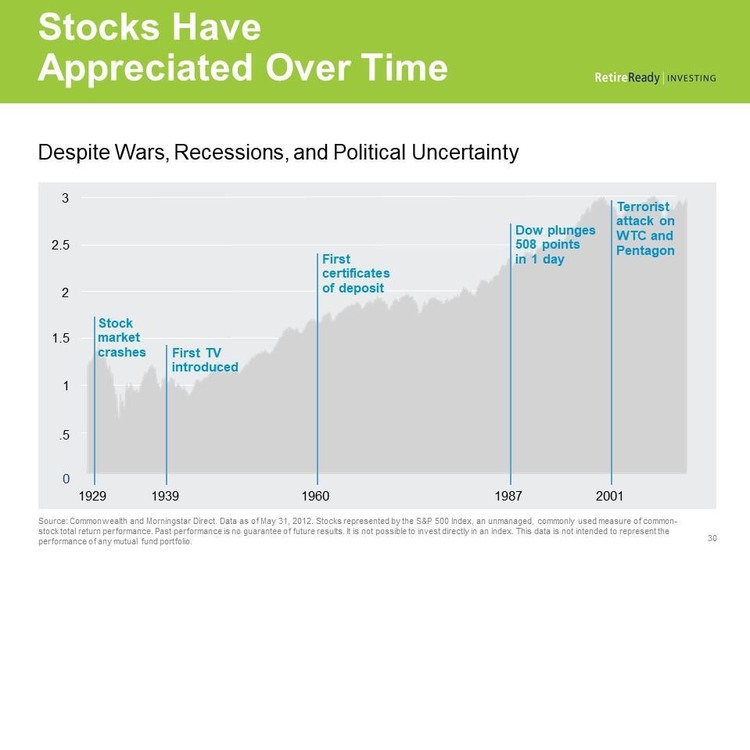

Remind yourself often of the reason why you invested in stocks in the first place: because stocks have been the best performers over time though they come with significantly greater risk. For many people, stocks are part of a long-term investing plan to help them pursue their financial goals. But with everything going on in the world, is now a great time to invest? Let’s take a look.

Slide 31

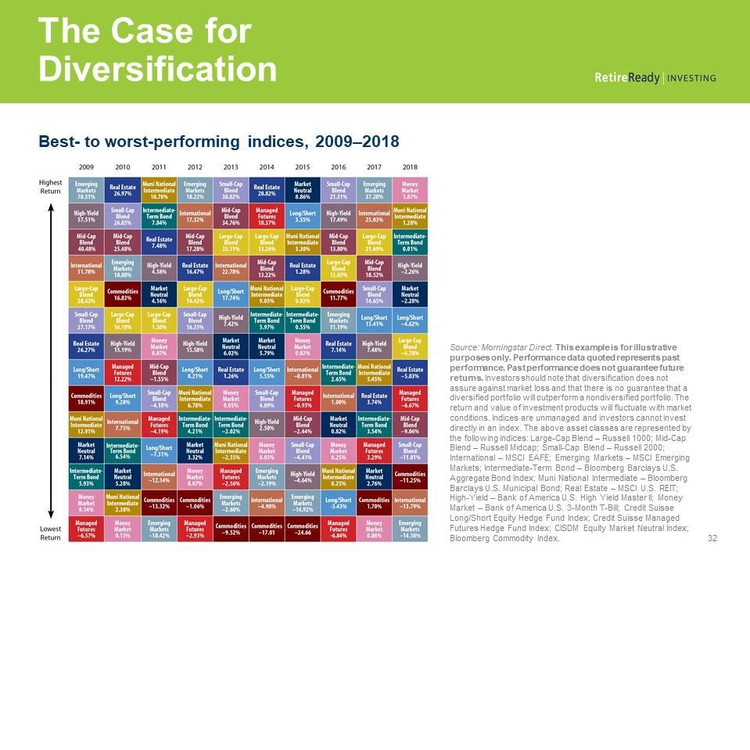

Diversification and asset allocation are similar in that they are both based on the classic idea of not “putting all your eggs in one basket.”

The difference is that asset allocation involves spreading investments among asset classes, whereas diversification involves spreading investments within each asset class. With diversification, you figure out what percentage of the various subclasses you should own and, within each of those subclasses, how many different stocks you need for a broad representative mix.

Both asset allocation and diversification may help lower risk and protect your portfolio from poor performance in any one asset class or industry. However, neither allocation nor diversification can guarantee against loss or ensure a profit.

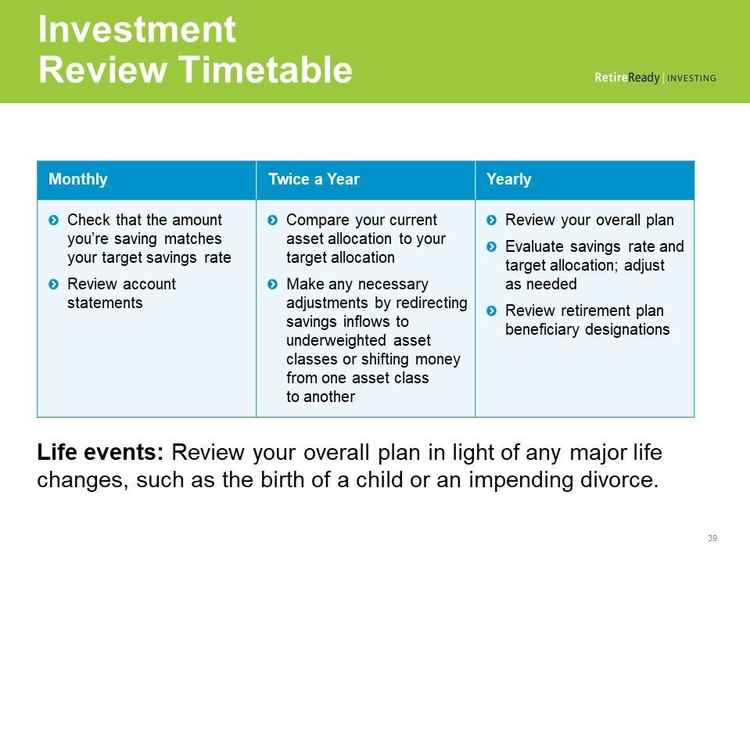

Slide 39

After you have reviewed your investment options, you may want to use this investment review calendar to help you stay on track toward your retirement income goals.

When reviewing your portfolio, it’s helpful to ask yourself some questions, such as:

If you are unsure of the answers or need assistance, you can speak with your financial advisor, use the tools on your plan’s website, or call one of your plan’s phone representatives.